Getting into a car accident is stressful enough—but discovering the other driver has no insurance can make things even worse. Texas law requires drivers to carry liability insurance, yet thousands of motorists operate vehicles without coverage. If you find yourself in this unfortunate situation, knowing what steps to take can make a critical difference in protecting your health, finances, and legal rights.

In this guide, the team at Eric Ramos Law, LLC outlines exactly what to do if you’re hit by an uninsured driver in Texas. For more guidance on navigating legal challenges after an accident, visit our personal injury blog.

1. Ensure Your Immediate Safety and Seek Medical Attention

Your health is always the top priority. After a crash:

- Move to a safe location if possible.

- Call 911 to report the accident.

- Request medical assistance, even if injuries seem minor.

Adrenaline can mask serious conditions. A full medical evaluation ensures timely treatment and also creates official documentation that may later support your claim.

Tip: Even soft tissue injuries like whiplash or concussions can develop or worsen over time. Learn more in our guide on soft tissue injuries after a car accident.

2. Contact Law Enforcement Immediately

In Texas, any crash involving injury, death, or property damage over $1,000 must be reported to the police. When an uninsured driver is involved, it’s especially important to have a police report on file. Law enforcement can:

- Document the uninsured status of the other driver

- Assign fault based on statements and evidence

- Provide an official report used in insurance and legal claims

Pro Tip: Be sure to get the officer’s name, badge number, and report number so you can request the official accident report later.

3. Gather Comprehensive Evidence at the Scene

Even though the other driver lacks insurance, collect as much information as possible:

- Driver’s name, contact info, and driver’s license number

- License plate number and vehicle description

- Photographs of the vehicles, damage, injuries, and scene

- Contact details for any witnesses

- Time, date, and weather conditions at the time of the crash

Why It Matters: Insurance companies and attorneys rely heavily on the details collected at the scene to build a strong case. Avoid mistakes that could harm your claim by reading about common personal injury claim mistakes.

4. Notify Your Insurance Company Promptly

Texas is an at-fault state, meaning the driver who caused the accident is responsible for damages. But when the at-fault driver has no insurance, you may need to rely on your own policy. Notify your insurance provider as soon as possible and ask about the following coverages:

a. Uninsured Motorist (UM) Coverage

This coverage pays for medical expenses, lost wages, pain and suffering, and vehicle repairs when you’re hit by an uninsured driver. Here’s how to maximize your uninsured motorist coverage.

b. Underinsured Motorist (UIM) Coverage

If the driver has some insurance but not enough to cover your damages, UIM fills in the gap.

c. Collision Coverage

Pays for repairs to your vehicle regardless of who was at fault.

d. Personal Injury Protection (PIP)

Covers medical bills and lost wages, even if you were at fault.

Note: In Texas, insurance companies are required to offer UM/UIM coverage, but policyholders can reject it in writing. Review your policy or speak to your agent.

5. Don’t Accept Cash Offers or Unofficial Settlements

Some uninsured drivers may offer to pay you out-of-pocket to avoid legal or financial penalties. While this may sound convenient, it’s rarely a good idea.

- You may not yet know the full cost of your medical treatment or vehicle repairs

- Verbal agreements are not legally bindin

- You may give up your right to claim fair compensation

Bottom Line: Always report the incident and follow a legal process.

6. Consult a Texas Personal Injury Attorney

Handling a crash with an uninsured driver can be complicated. An experienced attorney can:

- Analyze your case and identify all sources of compensation

- Guide you through the insurance claim process

- Represent you if your insurer refuses to pay fairly

- File a personal injury lawsuit if needed

At Eric Ramos Law, LLC, we focus exclusively on personal injury law. We understand the unique challenges that come with uninsured motorist claims and fight aggressively for our clients.

Bonus: We offer free consultations and work on a contingency basis—you don’t pay unless we win your case. If you’re unsure how personal injury lawyers are paid, here’s how it works.

7. Understand Legal Penalties for Uninsured Drivers in Texas

Driving without insurance in Texas comes with serious consequences:

- Fines between $175 and $1,000

- Driver’s license suspension

- Additional surcharges from the Texas Department of Public Safety

- Impoundment of the vehicle

- Civil lawsuits for any damages caused

These penalties are intended to deter drivers from breaking the law but may not directly help you recover your losses. That’s why knowing your legal rights is essential. Learn more in our Texas car accidents resource page.

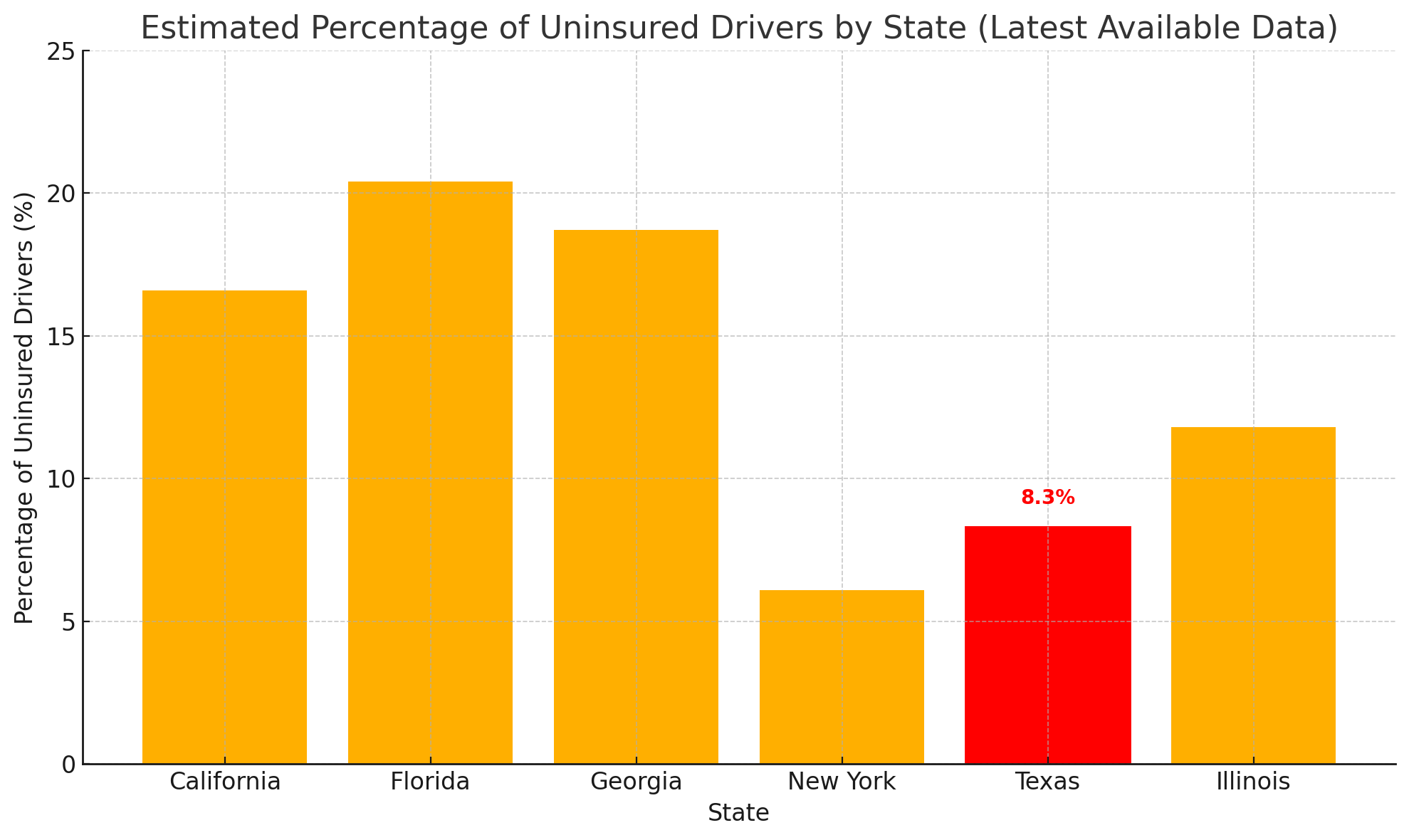

Visual Insight: How Common Are Uninsured Drivers?

While Texas law requires all drivers to carry liability insurance, the reality is far from ideal. As the chart below shows, Texas still ranks among the states with a significant percentage of uninsured drivers. This highlights why uninsured motorist coverage—and legal protection—are so essential for Texans on the road.

Estimated percentage of drivers without insurance by state. Source: Insurance Research Council.

8. Consider Filing a Civil Lawsuit for Damages

If your damages exceed the limits of your coverage and the at-fault driver has assets, your attorney may recommend filing a civil suit. While collecting may be challenging if the driver has limited financial resources, it is sometimes possible to:

- Garnish wages

- Place liens on property

- Secure structured settlements

Fact: Texas allows a two-year statute of limitations from the date of the accident to file a personal injury claim. If you’re preparing your case, start with these five essential steps.

9. Explore Additional Sources of Financial Support

In some cases, alternative forms of compensation may be available:

- MedPay Coverage: Optional medical payments coverage for quick bill payment.

- Texas Crime Victims’ Compensation Program: Available for victims of certain hit-and-run incidents.

- Health Insurance: Can be used to cover initial treatment if other options are delayed or denied.

Your attorney can help identify the most viable path based on your unique situation. If you’re not sure whether to continue with your current lawyer, here’s how to evaluate and possibly fire your injury lawyer.

10. Review Your Insurance Policy Now—Before an Accident Happens

The best way to prepare for an uninsured driver accident is to ensure you have sufficient coverage before one occurs. We recommend

- Carrying at least $30,000/$60,000 in UM/UIM coverage

- Including PIP or MedPay on your policy

- Reviewing coverage annually with your agent

Proactive Tip: Document your policy decisions and coverage limits in writing to avoid surprises during a claim. Learn about other car accident injury facts you should know.

Final Thoughts: You Have Legal Options

Being hit by an uninsured driver in Texas is frustrating and unfair. But you are not without options. By taking the right steps immediately and working with a skilled attorney, you can maximize your chances of recovering the compensation you deserve.

At Eric Ramos Law, LLC, we are committed to helping accident victims understand their rights and pursue justice. We fight hard to hold negligent drivers accountable—even when those drivers lack insurance.

Contact Us Today

Visit ericramoslaw.com or call us at (210) 404-4878 for a free, no-obligation consultation.